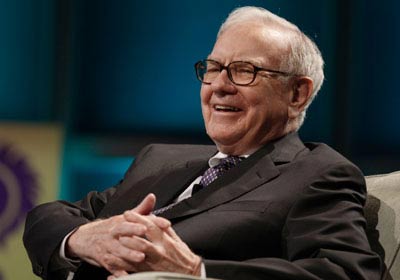

Today I had lunch at Jimmy John's and noticed a sign on the wall that showed Warren Buffet's list of 10 Rules. I was so moved by it that I had to change tables in the middle of my sandwich just to get a closer look. Is it any wonder that he is one of the richest men in the world?

今天我在吉姆约翰餐厅吃中饭,注意到墙上写的“股神巴菲特十大致富秘籍”。我真是被那些规则触动了,三明治吃到一半,我特意换了桌子离它近点儿好看清楚。(了解之后)我想不会有人质疑为什么他会是全世界最富有的人。

1. Reinvest your profits. 把你现有的财富做再投资

"Even a small sum can turn into great wealth," Schroeder writes, if you're disciplined to not touch your profits. Let the power of compound interest work for you.

就像史诺德写到过的那样:“再小的资金也能变成大财富”——只要你管好自己不乱花赚来的钱。要让复利(compound interest)帮你赚钱。

小编注:什么是复利?

指利息计算的基础是本金加先前累积的利息,与单利相对,后者指利息只以初始本金为计算基础。“按年复利”(compounding annually)是指当年利息只在一年结束时一次性纳入下一年的计息基础。例如,如果存入100英镑,年利率为10%,那么一年后可获得110英镑。如果按单利方式计算,两年后可获得120英镑,三年后则是130英镑,而复利计算则将上年的利息亦纳入计息基础,即两年后可得121英镑,三年后则是 133.10英镑。相对于单利方式,三年后额外的3.10英镑利息即是复利作用的结果。

2. Be willing to be different. 要愿意与众不同。

Don't follow the herd. Do what is best for you and your situation.

把自己区别于芸芸众生。做对自己和自己的处境有利的事儿。

3. Never suck your thumb. 永远都别吮手指。

Ah, how I could learn from this one. Buffett makes decisions quickly based on the available information. I tend to sit and stew about things. Acting decisively can give you an advantage and prevent procrastination.

额……这个该如何理解呢?巴菲特会根据已有的信息很快做出决定。我则倾向于坐下来、好好把事情理清楚。果断地做决定能够给你优势位置、并避免耽搁事情。

4. Spell out the deal before you start. 在做交易以前一定要搞明白了。

I stress this all the time: Don't sign a contract unless you've read it (especially not a mortgage). Read the fine print. Understand the what you're getting yourself into.

我成天为这事儿烦呢:在签合同以前一定要好好读清楚(特别当合同不是分期付款时)。条款一点一点读清楚,要知道自己正要做什么。

5. Watch small expenses. 小开销也要谨慎。

While it's true that the big things matter, the little things do too. Frugality is an important part of personal finance. But this principle also applies when investing, which is one reason I'm a fan of low-cost index funds.

大事儿要紧这没错,但小事儿同样也是的。节俭对个人理财来说是重要的一环。这个原则对于投资同样适用,这也是为什么我喜欢低成本指数基金的原因。

小编注:什么是指数基金(Index fund)?

指数基金是消极管理投资基金的主要形式,有时候被用来指代所有的消极管理投资基金。从广义上讲,ETF(交易所交易基金)也属于指数基金。

指数基金的投资理念是在证券市场上选定一部分符合条件的证券,这些证券可以通过客观标准(如总资本,总股本,成交量,主营业务)选定,也可以通过主观标准(如成长性,被市场低估的程度)选定;被选定的证券共同构成一个指数,每一个证券都拥有一个确定的权重(即该证券在整个投资组合中所占的比例),指数基金经理按照这个指数购买证券,建立一个与指数完全相同或基本相同的投资组合。

若投资指数基金做消极投资,主要是挑目标指数有可投资性的和跟踪误差小的,不必过分看中一时的收益。

6. Limit what you borrow. 要限制自己借钱的数量。

"Living on credit cards and loans won't make you rich," writes Schroeder. Sure, leverage can get you into a home or a new car, but too much debt is one of the biggest drags on your financial well-being.

史诺德写过“靠信用卡和贷款度日是不会变成富翁的。” 当然,用点儿小技巧是可以帮你买个房子、或者一辆新车,但是过多的借贷却会打破你的财政平衡。

7. Be persistent. 要坚持。

If you know what you're doing is important and right, stick to it. Doggedly pursue your goals. Learn to "fail forward".

如果你知道你做的事是重要且正确的,那就要坚持下去。顽强地追逐自己的目标。要学会“向前摔跤”。(小编注:即,要从每次错误中汲取教训)

8. Know when to quit. 要知道什么时候该退出。

The other day, I wrote about the danger of the sunk-cost fallacy. Just because you've already paid $10 to see Indiana Jones and the Kingdom of the Crystal Skull, doesn't mean you should sit through to the end. Be willing to cut your losses and walk away.

我曾经写到过沉没成本谬论的危险性。就因为你已经付了十块钱去看《夺宝奇兵4:水晶头骨》,不代表你就非要看完它。要乐于割肉、闪人。

小编注:什么是沉没成本(sunk cost)?

在经济学和商业决策制定过程中会用到“沉没成本”(sunk cost)的概念,代指已经付出且不可收回的成本。沉没成本常用来和可变成本作比较,可变成本可以被改变,而沉没成本则不能被改变。在微观经济学理论中,做决策时仅需要考虑可变成本。如果同时考虑到沉没成本(这被微观经济学理论认为是错误的),那结论就不是纯粹基于事物的价值作出的。举例来说,如果你预订了一张电影票,已经付了票款且假设不能退票。此时你付的价钱已经不能收回,就算你不看电影钱也收不回来,电影票的价钱算作你的沉没成本。

9. Assess the risks. 评估风险。

"Asking yourself ‘and then what?’ can help you see all of the possible consequences when you're struggling to make a decision — and can guide you to the smartest choice."

做决定前先问问自己“结果是什么?”,这能帮助你在纠结着要做决定时看清楚所有可能发生的后果,并能指引你做出最明智的抉择。

10. Know what success really means. 懂得什么才是真正的成功。

Success is different for each of us. Find what it is that brings meaning to your life, what makes each day important. Make this your focus. Buffett says: "When you get to my age, you'll measure your success in life by how many of the people you want to have love you actually do love you. That's the ultimate test of how you've lived your life."

对我们每个人而言成功的定义都不同。找到那个对你生命真正有意义的、会对每一天都有影响的。专注其中。巴菲特说:“当你到了我这个年纪,你会重新评估你的成功,你会在乎那些你想爱的人是不是真的爱你,这是对你一生过得如何的终极检验。”

相关阅读

英国调查:女性花钱比男性更谨慎

帮你做新年理财计划

理财秘籍:英媒评出省钱最怪20招

11条理财金规

(来源:沪江英语 编辑:Julie)