关于中美经贸摩擦的事实与中方立场

新华网 2018-09-25 10:36

三、美国政府的贸易保护主义行为

III. The trade protectionist practices of the US administration

美国存在大量扭曲市场竞争、阻碍公平贸易、割裂全球产业链的投资贸易限制政策和行为,有损以规则为基础的多边贸易体制,并严重影响中美经贸关系正常发展。

The numerous investment and trade restriction policies and actions adopted by the US that distort market competition, hamper fair trade, and lead to breakdowns in global industrial chains are detrimental to the rules-based multilateral trading system and severely affect the normal development of China-US economic and trade relations.

(一)歧视他国产品

1. Discrimination against foreign products

美国大量监管政策违反公平竞争原则,歧视他国产品,具有明显的利己主义和保护主义倾向。美国通过立法直接或间接限制购买其他国家产品,使他国企业在美遭受不公平待遇,中国企业是其中的主要受害者。

Many American regulatory policies are clearly self-serving and protectionist as they run counter to the principle of fair competition and discriminate against foreign products. The US directly or indirectly restricts the purchase of products from other countries through legislation, subjecting foreign companies to unfair treatment in the US, with Chinese companies being the main victims.

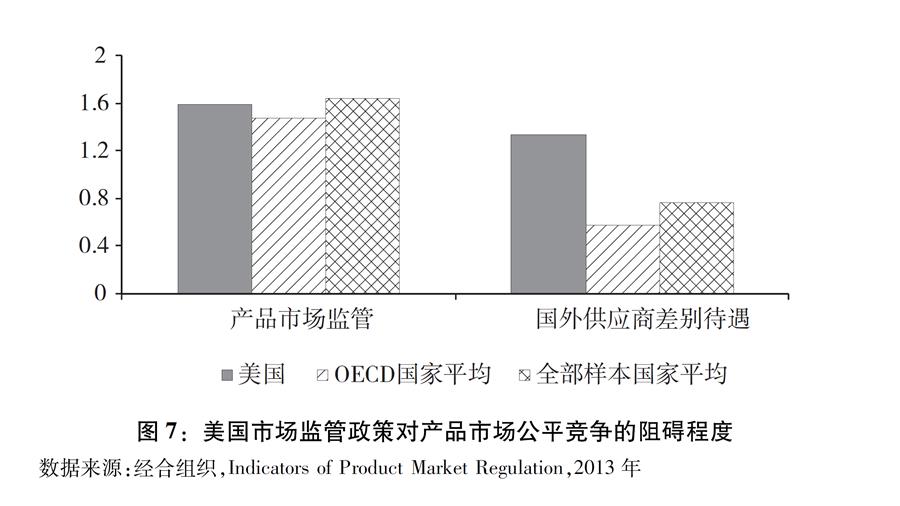

美国产品市场的公平竞争环境不如多数发达国家,甚至逊于一些发展中国家。根据经合组织发布的2013年“产品市场监管指标”(注30)对35个经合组织国家进行排名,前3位是荷兰、英国和澳大利亚。美国只排在第27位,反映出美国市场监管政策对产品市场公平竞争存在较多障碍。而在加入12个非经合组织国家的指标后,美国在47个国家中仅列第30位,其产品市场公平竞争环境不及立陶宛、保加利亚和马耳他等非经合组织国家。

The US product market falls behind most developed countries and even some developing countries in terms of fair competition. According to the statistics on Indicators of Product Market Regulation released by the OECD in 2013, the Netherlands, the UK and Australia were the top three among 35 OECD countries, while the US ranked only 27th, pointing to the many obstacles created by the US market regulatory policies for fair competition in the product market. When the indicators of 12 non-OECD countries were added, the US ranked only 30th among the 47 countries, indicating a product market environment less fair than those of non-OECD countries such as Lithuania, Bulgaria and Malta.

美国对他国产品的歧视程度远高于大多数发达国家,甚至也高于一些发展中国家。根据“产品市场监管指标”二级指标“国外供应商差别待遇”(注31)对35个经合组织国家进行排名,2013年美国排在第32位,表明美国产品市场对外国存在严重歧视。若包括12个非经合组织国家的指标,美国在47个国家中排名第39位,歧视程度比巴西、保加利亚、塞浦路斯、印度、印度尼西亚和罗马尼亚等非经合组织国家更高(注32)(图7)。

The US is far more discriminatory against foreign products than most developed countries and even some developing countries. According to the ranking of 35 OECD countries on Differential Treatment of Foreign Suppliers , a secondary indicator of the Indicators of Product Market Regulation, the US ranked 32nd among 35 OECD countries in 2013, indicating severe discrimination against foreign countries in its product market. When the indicators of 12 non-OECD countries were added, the US ranked 39th among the 47 countries, with a higher degree of discrimination than such non-OECD countries as Brazil, Bulgaria, Cyprus, India, Indonesia and Romania (Chart 7).

美国通过立法严格要求政府部门采购本国产品,并对采购他国产品设置歧视性条款。例如,《购买美国产品法案》规定,美国联邦政府机构仅能采购在美国生产的加工最终产品以及在美国开采或生产的未加工品(注33)。《美国法典》规定,针对申请联邦政府或州政府资助的公共交通项目,必须使用美国国产的铁、钢和制成品(注34)。《农业、农村发展、食品和药品管理及相关机构拨款法案》规定,拨款资金不得为学校午餐、儿童成人关照食品、儿童夏日食品服务、学校早餐等项目购买从中国进口的生的或加工过的家禽产品。(注35)《国防授权法案》以国家安全为由,规定禁止联邦政府采购中国企业提供的通讯设备和服务(注36)。

The US, by way of legislation, sets strict requirements on its government departments to “buy American” and imposes discriminatory terms on purchasing foreign products. For example, the Buy American Act stipulates that US federal agencies can only acquire manufactured products made in America and unmanufactured articles that have been mined or produced in America. According to the Code of Laws of the United States of America, an application for a public transport project receiving federal or state funding can be granted only if the steel, iron and manufactured goods used in the project are produced in the US. According to the Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Appropriations Act, none of the funds made available by this Act may be used to procure raw or processed poultry products imported into the US from China for use in the school lunch program, the Child and Adult Care Food Program, the Summer Food Service Program for Children or the school breakfast program. The National Defense Authorization Act prohibits the federal government from procuring telecommunications equipment and services provided by Chinese companies on the grounds of national security.

(二)滥用“国家安全审查”,阻碍中国企业在美正常投资活动

2. Abuse of “National Security Review” as a way to obstruct the normal investment activities of Chinese companies in the US

美国是全球范围内最早对外国投资实施安全审查的国家。1975年,美国专门成立外国投资委员会,负责监测外国投资对美国的影响。1988年,美国通过《埃克森-弗洛里奥修正案》,对《1950年国防生产法》进行了修正,授权美国总统及其指派者对外资并购进行审查。《2007年外商投资与国家安全法案》扩充了外国投资委员会(注37),扩大其安全审查范围。从半个多世纪的立法过程看,美国对外国投资实施安全审查的主线就是收紧法规政策,扩大监管队伍和审查范围,近期特别针对中国强化了审查和限制。

The US is the first in the world to conduct security reviews on foreign investment. In 1975, the Committee on Foreign Investment in the United States (CFIUS) was established for the specific purpose of monitoring the impact of foreign investment in the US. In 1988, the Exon-Florio Amendment revised the 1950 Defense Production Act by mandating the US President and people with the authority to review foreign takeovers. The Foreign Investment and National Security Act of 2007 expanded CFIUS and broadened its scope of review. The legislation process in the US over the past 50 years shows that the US security review of foreign investment has mainly been characterized by tighter laws, regulations and policies, expanded regulatory teams and scope of reviews, and more recently, intensified screening and restrictions vis-à-vis China.

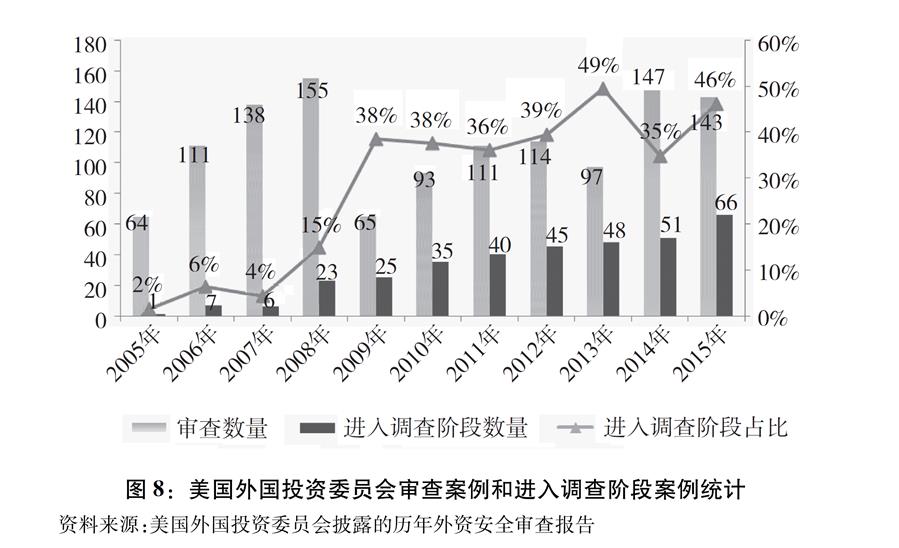

在外商投资安全审查实践中,美国“国家安全审查”的依据模糊不清,审查力度不断加大。根据美国外国投资委员会的历年外资安全审查报告(注38),2005-2008年审查外国投资交易案例468起,其中需要进入调查阶段的案例37起,占比仅8%。但自2008年美国财政部发布《外国人合并、收购和接管规制:最终规则》(注39)以后,2009-2015年期间审查的770起案例中,需要进入调查阶段的达到310起,占比陡然提高到40%。尤其是在最新披露的2015年数据中,这一比例进一步提高到46%,处于较高水平(图8)。

In practice, the US “national security review” is often based on flimsy evidence and is becoming increasingly stringent. According to CFIUS annual reports to Congress, the Committee reviewed 468 foreign investment transactions from 2005 to 2008, only 37 of which (8 percent) entered the stage of investigation. However, since the Department of the Treasury issued the Regulations Pertaining to Mergers, Acquisitions, and Takeovers by Foreign Persons in 2008, among the 770 cases reviewed between 2009 and 2015, 310 cases – 40 percent of the total – passed on to the stage of investigation, which represents a noticeably sharp rise. In particular, the latest data released in 2015 shows this percentage climbing to an even higher level of 46 percent (Chart 8).

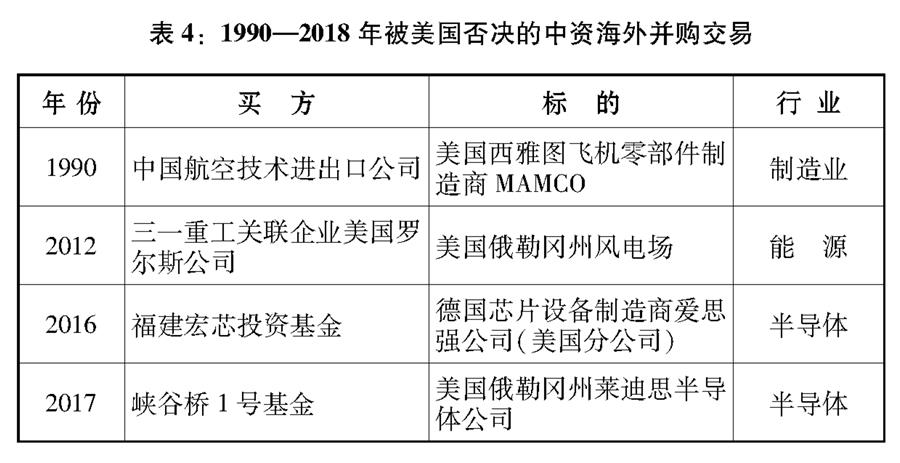

中国企业是美国滥用国家安全审查的主要受害者之一。美国外国投资委员会成立以来,美国总统根据该委员会建议否决的4起投资交易均系针对中国企业或其关联企业。2013-2015年,美国外国投资委员会共审查39个经济体的387起交易,被审查的中国企业投资交易共74起,占19%,连续三年位居被审查数量国别榜首。从近年来美国否决和阻止中国企业投资的数据来看(表4和表5),美国外国投资委员会对华投资审查范围已从半导体、金融行业扩大至猪饲养等食品加工业。加上其审查程序不透明、自由裁量权极大、否决原因披露不详等因素,以“危害国家安全”为由阻碍正常交易的情况更为严重。

Chinese companies are one of the main targets of the US abuse of national security reviews. Since the establishment of CFIUS, US Presidents vetoed four transactions based on the Committee’s recommendation, all targeting Chinese firms or their related businesses. From 2013 to 2015, CFIUS reviewed in total 387 transactions concerning 39 economies, among which 74 were transactions involving investment from Chinese companies, accounting for 19 percent of the total, the largest share among all countries for three years in a row. The data on Chinese corporate investment being vetoed and blocked by the US (Table 4 and Table 5) shows that CFIUS review of Chinese investment has extended its reach from semiconductors and financial sectors to food processing sectors including swine feed. In addition to an absence of transparency in the review process, excessive discretionary power, and lack of explanations for vetoes, there is an even more serious issue – that normal transactions are being obstructed on the grounds of national security.

美国新立法进一步加强外资安全审查。2018年8月13日,美国总统签署了《2019财年国防授权法案》,作为其组成部分的《外国投资风险审查现代化法案》赋予了外国投资委员会更大审查权,包括扩大受管辖交易范围、扩充人员编制、引入“特别关注国”概念、增加考虑审查因素等,投资审查收紧趋势明显。其中,特别要求美国商务部在2026年前每两年提交一份关于中国企业在美投资情况的分析报告(注40)。

The United States is preparing new legislation for more stringent foreign investment security review. On August 13, 2018, the President signed the National Defense Authorization Act for Fiscal Year 2019, part of which is the Foreign Investment Risk Review Modernization Act (FIRRMA), which strengthens the authority of CFIUS, expands the scope of transactions covered, recruits additional staff, establishes the term of “countries of special concern”, and adds additional factors to be considered in reviews. All of this points to a clear trend of tighter investment reviews. In particular, it requests the Department of Commerce to submit a biennial analysis on Chinese investments in the US before 2026. .

(三)提供大量补贴,扭曲市场竞争

3. Large subsidies that distort market competition

美国联邦和地方政府对部分产业和企业提供大量补贴、救助和优惠贷款,这些补贴行为在很大程度上阻碍了市场的公平竞争。根据美国补贴监控组织“好工作优先”统计,2000-2015年间,美国联邦政府以拨款、税收抵免等方式至少向企业补贴了680亿美元,其中582家大公司获得的补贴占总额的67%(注41)。同一时期,美国联邦机构向私人部门提供了数千亿美元的贷款、贷款担保和救助援助。享受美国政府补贴的行业十分广泛,在列入统计的49个行业中,汽车、航空航天和军工、电气和电子设备、油气、金融服务、化工、金属、零售、信息技术等均在前列(注42)。美国州和地方政府也给予了企业大量补贴。由于州政府在补贴方面基本不受联邦政府的管辖,其补贴方式及金额透明度低,具有较大隐蔽性,实际补贴额远高于其披露数额。

US governments at federal and sub-national levels provide large subsidies, bailout assistance, and concessional loans to some sectors and companies. Such actions obstruct, to a large extent, fair market competition. According to Good Jobs First, an American organization that tracks subsidies, between 2000 and 2015, the federal government provided at least US$68 billion in grants and special tax credits to businesses, with 582 large companies receiving 67 percent of the total. During the same period, federal agencies gave the private sector hundreds of billions of dollars in loans, loan guarantees, and bailout assistance. A wide range of sectors received government subsidies. Motor vehicles, aerospace and military contracting, electrical and electronic equipment, oil and gas, financial services, chemicals, metals, and retailing and information technologies ranked among the top of the 49 tracked sectors. State and local governments also gave enormous subsidies to companies. The amounts of subsidies at the state level are basically not subject to federal jurisdiction, hence the difficulty in assessing their specific scale and nature. Actual amounts of the state-level subsidies are much higher than the disclosed figures.

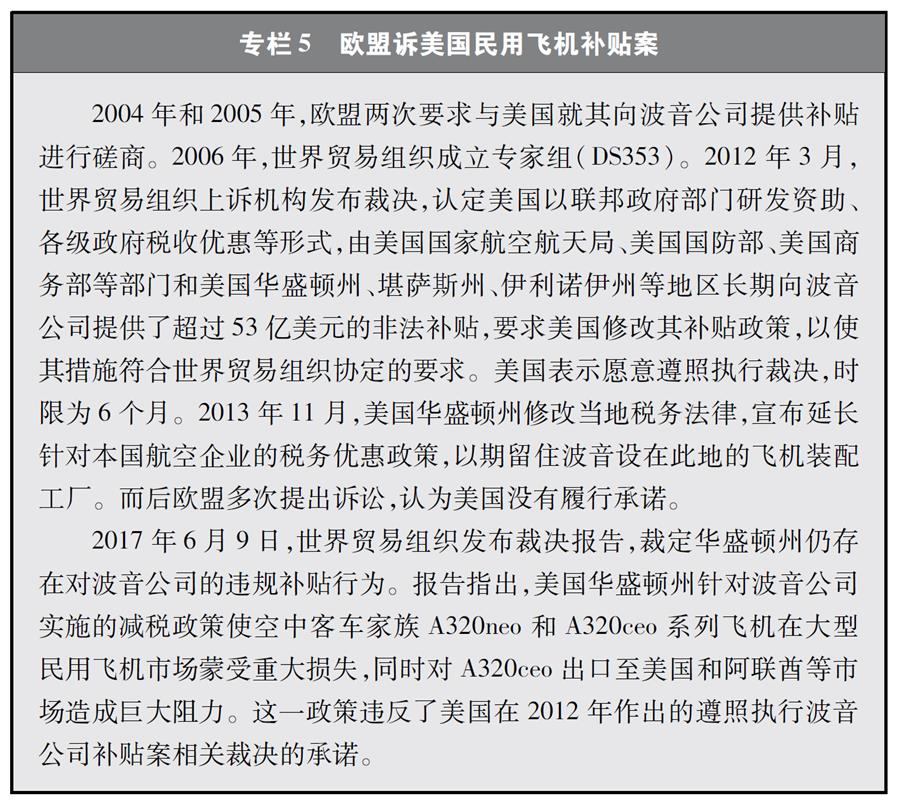

在航空领域,美国波音公司2000年以来获得联邦和州(地方)政府的定向补贴金额145亿美元;2011年以来获得来自各级政府的贷款、债券融资、风险投资、贷款担保、救助等737亿美元(注43)(专栏5)。

In the aviation sector, Boeing has received US$14.5 billion of allocated subsidies from the federal and state/local governments since 2000 and US$73.7 billion of loans, bond financing, venture capital, loan guarantees and bailout assistance from governments at various levels since 2011 (Box 5).

Box 5 EU Challenge to US Civil Aircraft Subsidy

In 2004 and 2005, the EU twice requested consultations with the United States concerning subsidies provided to Boeing. In 2006, the WTO established the DS353 panel. In March 2012, the WTO Appellate Body report affirmed the value of prohibited and/or actionable subsidies granted by NASA, the Department of Defense, the Department of Commerce and other federal departments, and the States of Washington, Kansas and Illinois to Boeing over a long period, in the form of research and development assistance by the federal government and tax credits by governments at other levels, to be at least US$5.3 billion, and called upon the United States to revise its subsidy policy in compliance with WTO agreements. The United States expressed its intention to implement the rulings over a six-month period. In November 2013, the State of Washington revised its local tax legislation and announced an extension of the tax credit policy for domestic aviation companies to keep Boeing assembly lines in the State. The EU made several accusations about the US non-compliance.

On June 9, 2017, the WTO issued a report which ruled that the State of Washington was still providing prohibited subsidies to Boeing. The report confirmed significant lost sales of the A320neo and A320ceo families in the large civil aircraft market and a threat of impedance of exports of A320ceo to markets in the United States and the United Arab Emirates due to the State of Washington’s tax reduction policy for Boeing. The policy violated the US commitment to compliance with the rulings in 2012.

图表:专栏5 欧盟诉美国民用飞机补贴案 新华社发

在汽车行业,美国联邦和州政府均有对汽车的扶持政策,并向大型汽车企业提供巨额救助和变相补贴。国际金融危机期间,美国政府在“不良资产援助计划”下设立“汽车产业资助计划”(AIFP),为大型汽车企业提供了近800亿美元的资金救助(注44)。2007年,美国能源部依据《2007年能源独立和安全法案》第136条款制定了“先进技术汽车制造贷款项目”,美国国会对该项目的授权贷款总额达到250亿美元(注45)。特斯拉公司自2000年以来得到美国联邦和州(地方)政府超过35亿美元的补贴(注46)。

In the automotive industry, the US government at both federal and state levels supports the auto industry with preferential policies and provides key auto companies with large bailouts and disguised subsidies. During the global financial crisis, the US government, with its Automotive Industry Financing Program (AIFP) under the Troubled Asset Relief Program (TAPR), provided key auto companies with nearly US$80 billion of assistance. In 2007, the US Department of Energy, citing Section 136 of the Energy Independence and Security Act of 2007, introduced the Advanced Technology Vehicles Manufacturing Loan Program (ATVM), with authorization from the US Congress, to provide up to US$25 billion in loans. Since 2000, Tesla has received more than US$3.5 billion in subsidies from US federal and state/local governments.

在计算机和半导体制造领域,美国事实上早就在执行由政府引导的产业政策。上世纪80年代,美国政府对美国半导体制造技术战略联盟拨款10亿美元,以创造具有“超前竞争性”的技术,保持美国技术领先地位,避免过度依赖外国供应商。苹果公司研发的几乎所有产品,包括鼠标、显示器、操作系统、触摸屏等,都得到了美国政府部门的支持,甚至有些直接萌芽于政府实验室。

In the field of computer and semiconductor manufacturing, the US has long adopted government-led industrial policies. The US government allocated US$1 billion in the 1980s to SEMATECH to support cutting-edge research, with a view to maintaining America’s leading position in this area and preventing over-reliance on foreign suppliers. Apple’s research and development on nearly all of its products, including the mouse, the display, the operating system, and the touch screen, received support from US government departments, with some of them created directly in labs run by the government.

在军工领域,美国对军工企业提供了包括税收优惠、贷款担保、采购承诺等不同形式的支持,对濒临破产的大型军工企业提供临时性政府贷款、企业重组基金、破产保护、过渡基金和债务减免等优惠政策。《2014年美国国防生产法案》规定,“总统可授权担保机构向私营机构提供贷款担保,以资助该担保机构认定的,对建立、维护、扩大、保护或恢复国防所需生产或服务至关重要的任何军工承包商、分包商、关键基础设施或其他国防生产供应商等”。2016年,全球最大的军工企业洛克希德·马丁公司获得康涅狄格州2亿美元资金支持。

In the military-defense industry, the US has supported related enterprises with preferential taxes, loan guarantees, procurement commitments, etc. Large military-defense enterprises on the brink of bankruptcy have been offered special government loans, restructuring funds, bankruptcy protection, transitional funds, debt relief and other preferential policies. As provided in the 2014 Defense Production Act, “The President may authorize a guaranteeing agency to provide guarantees of loans by private institutions for the purpose of financing any contractor, subcontractor, provider of critical infrastructure, or other person in support of production capabilities or supplies that are deemed by the guaranteeing agency to be necessary to create, maintain, expedite, expand, protect, or restore production and deliveries or services essential to the national defense”. In 2016, Lockheed Martin, the world’s largest military-defense company, obtained US$200 million from the State of Connecticut.

在农业领域,美国长期对农业实施高额财政补贴政策,世界上绝大多数农业补贴政策均起源于美国。根据乌拉圭回合谈判的结果,美国可在191亿美元的补贴上限内对各单项产品提供“黄箱”补贴。凭借雄厚的财力和充裕的补贴空间,美国对其大量出口的农产品提供了高额补贴。这些补贴影响了世界农产品的公平竞争,多次遭到相关国家挑战,巴西与美国之间历时12年之久的陆地棉补贴案就是典型代表。2014年,美国对农业补贴政策作出重大调整,以“价格损失保障计划”和“农业风险保障计划”替代原有的“反周期支付”等直接补贴计划,但仍与价格挂钩,“黄箱”补贴的性质并未变化,而支持水平却持续增加。美国农业部前首席经济学家约瑟夫·格劳勃等指出,这两种保障计划设定的参考价格均高于过去的目标价格,实际是提高了补贴支持水平(注47)。美国国会研究局的测算表明,两项保障计划2015年和2016年支出分别为101亿美元和109亿美元,而且2016-2017年度支持水平超出了2014年新法案出台前的水平(注48)。其中,对各单项产品支持的总金额接近150亿美元,为近10年的最高水平(注49)。此外,美国还通过各类信用担保计划促进农产品出口,并通过各类非紧急粮食援助计划将大量过剩农产品转移到国外,导致了严重的商业替代,对受援国当地农产品市场造成严重干扰,侵害了其他农产品出口国的利益。

In agriculture, high subsidies have long been a policy of the US, the birthplace of the majority of agriculture subsidies in the world. As a result of the WTO Uruguay Round negotiations, the US can give all individual items up to US$ 19.1 billion in amber box subsidies. With abundant financial resources and extensive room for subsidies, the US provides high subsidies for its huge agricultural exports. These subsidies undermine fair international competition and have been repeatedly challenged by other countries, a case in point being the 12-year-long dispute with Brazil over the upland cotton subsidy. In 2014, as part of a major adjustment to its agriculture subsidy policy, the US replaced direct subsidy programs, such as the Counter-cyclical Payment, with the Price Loss Coverage Program and the Agricultural Risk Coverage Program. Simply another form of amber box subsidy, these price-pegged subsidies resulted in a higher level of support. Joseph Glauber, the former chief economist of the US Department of Agriculture, pointed out that these two coverage programs, with reference prices set higher than the target prices of the past, in fact raised the level of subsidy support. According to the Congressional Research Service, the two programs together cost US$10.1 billion in 2015 and US$10.9 billion in 2016. The 2016-2017 support level was higher than before the introduction of the act in 2014. A total of nearly US$15 billion was spent in support of individual items, the highest in nearly a decade. The US also boosted its agricultural exports through various forms of credit guarantee programs. On top of that, the US sent a large volume of the excess farm produce abroad as non-emergency food aid, which led to serious problems of commercial substitution, distorting local agricultural markets in the recipient countries, and undermining the interests of other agricultural exporting countries.

(四)使用大量非关税壁垒

4. Use of large-scale non-tariff barriers

世界贸易组织并不完全禁止对国内产业实行保护,但原则是削减非关税壁垒、提升政策措施透明度,使其对贸易的扭曲减少到最低限度。美国采用大量更具隐蔽性、歧视性和针对性的非关税壁垒,对国内特定市场施以严格保护,明显扭曲了贸易秩序和市场环境。

While the WTO does not completely prohibit countries from protecting their domestic industries, certain principles must be followed, including lower non-tariff barriers, greater transparency of policies and measures, and a minimal level of trade distortion. The US has put in place a large number of discriminatory non-tariff barriers that are more targeted yet disguised, in an effort to keep specific segments of the domestic market under strict protection. This approach constitutes a notable distortion of the trade order and market environment.

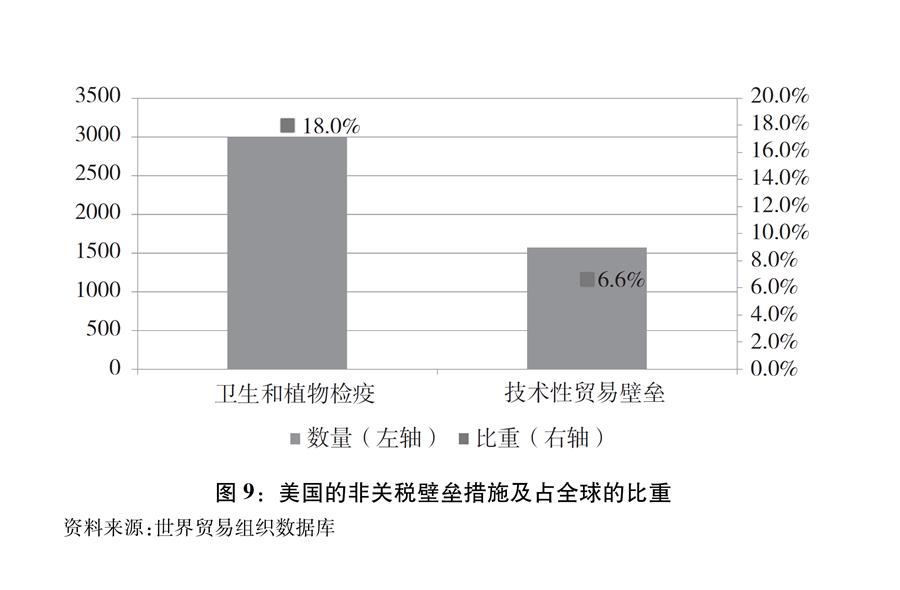

根据世界贸易组织统计,美国当前已通报的卫生和植物检疫以及技术性贸易壁垒措施分别有3004项和1574项,占全球的比重分别高达18%和6.6%(图9)。联合国贸发组织2018年6月29日的报告《对贸易监管数据的分析揭露新的重大发现》(注50)中提到,要把一棵树进口到美国,需满足54项卫生和植物检疫措施相关要求。这些措施严重影响了货物通关效率,增加了贸易成本。

According to the WTO, the US has reported 3,004 sanitary and phytosanitary (SPS) measures and 1,574 technical barriers to trade (TBT) measures, accounting for 18 percent and 6.6 percent of the world’s total (Chart 9). As reported in the UNCTAD’s “Analysis of Trade Regulations Data Flags Important New Findings” on June 29, 2018, a tree has to meet 54 SPS requirements before it can be imported into the US. These technical barriers have significantly lowered customs clearance efficiency and raised trade costs.

(五)滥用贸易救济措施

5. The abuse of trade remedy measures

根据世界贸易组织规定,成员方在进口产品存在倾销、补贴或进口过快增长对国内产业造成损害的情况下,可以使用贸易救济措施,但有严格限定条件。美国大量使用贸易救济措施对本国产业实施保护,其中相当大一部分针对中国。

While the WTO allows the use of trade remedy measures when a member economy finds damage caused to its domestic industries by dumping, subsidy or excessive growth in imports, strict limits and conditions do apply. However, the US has resorted to a huge number of trade remedy measures to protect its domestic industries. Many of these measures target China.

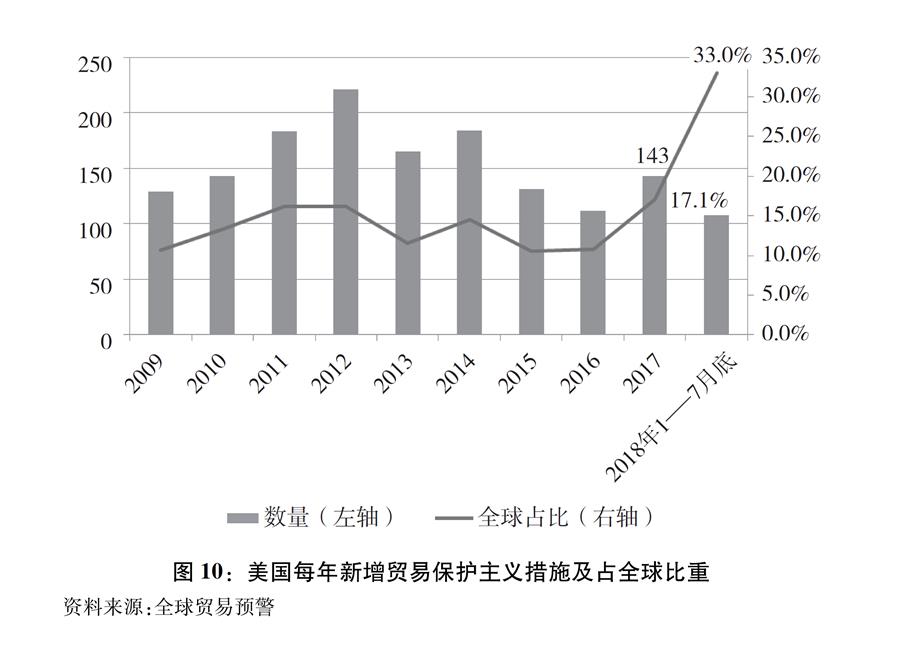

美国贸易保护主义措施增多,在全球占比不断提高。全球贸易预警(Global Trade Alert)统计数据显示,2017年,全球共有837项新的保护主义干预措施,其中美国出台143项措施,占全球总数的17.1%。2018年1-7月底,美国出台的保护主义措施占全球比重达到33%(图10)。

The US is adopting a growing number of trade protectionist measures, whose share of the world’s total is also rising. According to Global Trade Alert, among the 837 new protectionist measures adopted in 2017 worldwide, 143 (or 17.1 percent) were from the US. From January to the end of July in 2018, the US accounted for 33 percent of all protectionist measures in the world (Chart 10).

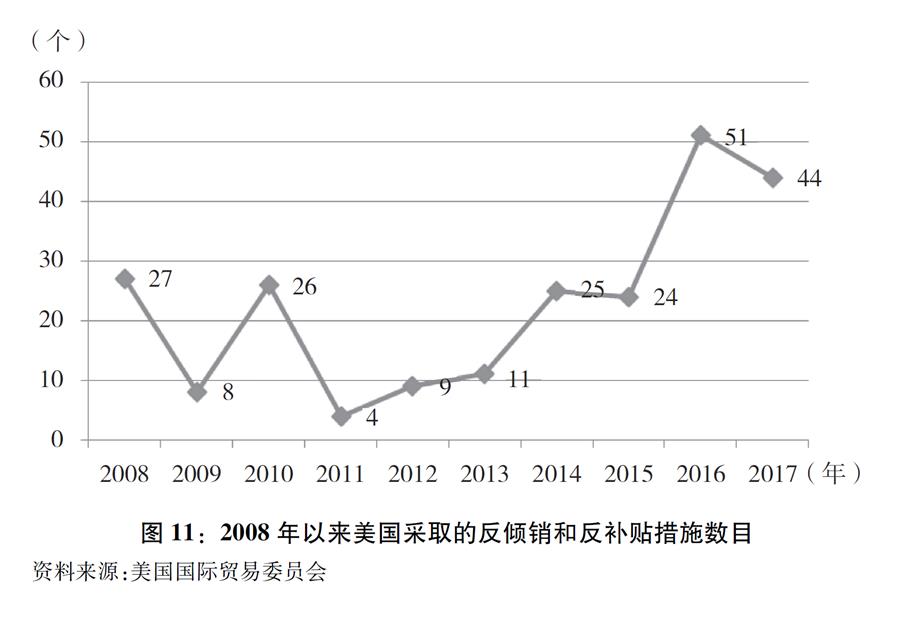

美国国际贸易委员会的统计数据显示,截至2018年7月17日,美国仍在生效的反倾销和反补贴措施共有44项(图11),其中58%是2008年金融危机以来新采取的“双反”措施,主要针对中国、欧盟和日本。

According to the United States International Trade Commission, by July 17, 2018 there were 44 anti-dumping and countervailing measures in effect in the US (Chart 11), among which 58 percent were adopted after the 2008 financial crisis, with China, the EU and Japan as the main targets.

在反倾销调查中,美国拒不履行《中国加入世贸组织议定书》第15条约定的义务,继续依据其国内法,对中国适用“替代国”做法。根据美国国会问责局的测算,被认定为市场经济的国家所适用的反倾销税率明显低于非市场经济国家。一般来说,美国对中国的反倾销税平均税率是98%,而对市场经济国家的平均税率为37%(注51)。2018年以来,美国作出18项涉及中国产品的裁决,其中14项税率都在100%以上。此外,美国在替代国的选择上也具有较大随意性(注52)。中国出口商在美国的倾销调查中受到严重不公正和歧视性对待。

In anti-dumping investigations, the US has refused to honor its obligation under Article 15 of China’s WTO Accession Protocol and continued to use the surrogate-country approach, citing its domestic law. The Government Accountability Office (GAO) of the US Congress calculated that the rates of anti-dumping duties applied to countries recognized as market economies are notably lower than those applied to non-market economies (NMEs). The average anti-dumping duty imposed by the US on China is 98 percent, while that on market economies is 37 percent. Among the 18 US rulings concerning Chinese products since the start of 2018, 14 had rates of more than 100 percent. Moreover, the US picks surrogate countries rather randomly, making the results of anti-dumping investigations highly unfair and discriminatory for Chinese exporters.

英语点津微信

英语点津微信 双语小程序

双语小程序