This is the VOA Special English Economics Report.

Facebook is the world's biggest social network -- and the subject of the movie "Social Network."

"People want to go on the Internet to check out their friends, so I want to build up the website that offers friends' pictures, profiles."

The real Mark Zuckerberg and his friends at Harvard University launched the site in 2004. Facebook says it reached 500 million users last July.

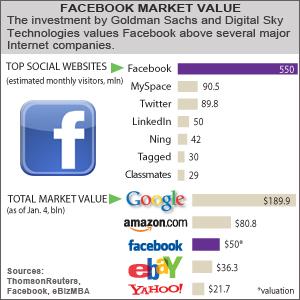

Now, the American bank Goldman Sachs and the Russian company Digital Sky Technologies have friended Facebook. They are investing a total of 500 million dollars in the company. The deal values Facebook at 50 billion dollars -- more than many publicly traded Internet companies.

Goldman Sachs is expected to raise a billion and a half dollars more by selling shares of ownership in Facebook to rich investors. The plan does not include a public stock offering -- at least not right now.

For now, Facebook would remain a private company -- meaning a company that does not sell shares to the public. The plan has brought new attention to the largely secretive world of private financing and the rules for private companies in the United States.

The idea is that investors in public companies have protections that investors in private companies do not. The Securities and Exchange Commission says a private company must report financial information if it has 500 shareholders or more.

A new business, a startup company, is usually considered too risky for average investors. But a promising startup may find a small number of private investors, often known as "angels." These investors are willing to lose everything for a chance at big returns.

Rikki Tahta has been involved in raising money for startups. He is now chairman of his own investment company, Covestor, with offices in New York and London.

Mr. Tahta compares the difference between public and private companies to the difference between marriage and dating. When people are dating, he says, there are understandings but few rules. In marriage, the rules are more clear and well-defined.

In his opinion, the only real benefit for a private company is lower administrative and record-keeping costs. Yet he tells us Covestor remains a private company after a few years because it is still too risky for most investors.

And that's the VOA Special English Economics Report, written by Mario Ritter. You can comment on our programs and find transcripts and MP3s at voaspecialenglish.com. We're on Facebook, Twitter and YouTube at VOA Learning English. I'm Steve Ember.

Facebook has 500 million users around world

Privacy concerns hit Facebook, Google

(来源:VOA 编辑:崔旭燕)